Financially Speaking

From Shabri

Recently, long-time clients said “because of you, our entire family (about 19 people) are going on a vacation together this spring”. They went on to tell us that they had rented a large home in the Poconos and that all of their children and grandchildren would be there together. The home was big enough that everyone, even the kids, had their own rooms, and there was an indoor pool! They had arranged for a chef to prepare dinners so everyone could relax and enjoy their time together. Hearing stories like that is truly the best part of our job!

The agenda for a typical meeting at our office includes discussions about life, family, economic conditions, investment outlooks, a financial plan review and investment portfolio analysis. While these are the basics of the work that we do, it is the discussions that go above and beyond the typical meeting that are the most gratifying.

Over the years, we have had the privilege of facilitating multi-generational family meetings to provide the opportunity for open dialogue between parents, adult children and sometimes grandparents. The discussions include understanding family values, how a family amassed their wealth, best practices of legacy families, the opportunities/challenges/responsibilities of wealth, estate planning and philanthropy. During this meeting we ask the family to begin to create a Family Mission Statement that defines the overarching purposes of the family. This includes defining individual as well as family goals, and how each member of the family will support each other in achieving those goals. As with business mission statements, we emphasize that a family’s mission statement should be SMART: specific, measurable, achievable, relevant and time bound.

Towards the end of last year, we met with a family who felt that charitable giving on a local level was an important part of their mission statement. We discussed several options with them and they ultimately decided to establish a Donor Advised Fund. The parents plan to add to this fund at periodic intervals and the family will decide annually which organizations will receive donations. The goal is that the adult children will continue this family tradition as part of their charitable giving.

As your team of wealth managers and financial advisors, we know that your planning needs extend far beyond managing your portfolio. We know that it is never really about the money, but rather what the money can do for you, and the people and causes that are most important to you. Our role is to help you define and implement processes that will allow you to achieve your goals.

In this quarter’s newsletter you will find our Moore Wealth Quarterly Economic Update and Sean’s article about interest rates/what the fed is doing and what that means for you.

We have been seeing clients in the office since the last quarter of 2021. We look forward to seeing you in person soon!

Your Portfolio

Spring 2022

From Sean Moore

What’s the Deal with Interest Rates?

The Federal Reserve raised interest rates in the recent past, and has laid out a plan – the details of which seem to vary with some regularity – to do so a number of times during the remainder of 2022. Though this seems to be discussed non-stop, particularly in business, market, and economic news, you might not be clear on what is actually happening, or why it matters. The goal of this article is to lay out the basics, so that you can be a more thoughtful consumer of the information you are receiving.

First and foremost, what do people mean when they say “interest rates?” In this case, the discussion is of the Federal Funds Rate (FFR), and more specifically the target range of the FFR set by the Fed.

Banks need to keep enough cash on hand – reserves – to meet demand for withdrawals. When they think their reserves might fall too low, they borrow from another bank that has excess reserves. This is done overnight, so these loans are called overnight loans, interbank loans, or overnight federal funds transactions.

The interest rate that banks charge when making these loans is the Federal Funds Rate (FFR), also called the interbank or the overnight rate. The FFR is the lowest rate a bank would ever charge on a loan because the loan is only overnight, and the borrower is another bank – as safe a borrower as there is.

So why does the Fed care about the FFR? Banks keep a percentage of their reserves in an account at the Fed. They used to be legally required to keep them in a non-interest paying account at the Fed, but that requirement has been eliminated, and the Fed now pays interest on reserve accounts. The reserve funds they keep at the Fed are the funds banks use to make overnight loans – this is why the system is called the Federal Funds Market.

The Fed establishes a target range for the FFR, and then raises or lowers the range to stimulate or dampen economic activity. The logic of why they change the target range is this: if banks pay a higher rate on money borrowed in the Federal Funds Market, they will charge a higher rate on loans to their customers. When customers face higher rates, they will tend to borrow less money, which in turn tends to lead to less economic activity – referred to as “contractionary monetary policy.” The opposite is also true: when banks lower the target range of the Federal Funds Rate, banks pay a lower rate on money borrowed in the Federal Funds Market, and then charge a lower rate on loans to customers, leading to more borrowing, generating more economic activity – referred to as “expansionary monetary policy.”

You’ve likely noticed my use of the phrase “target rate.” This is because the Fed doesn’t just dictate the FFR – the banks involved in a particular loan actually decide on the rate. The Fed does influence the FFR using the Interest on Reserve Balances (IORB) rate. The IORB is the rate the Fed pays on the reserves banks keep at the Fed. The FFR tends toward the IORB because the IORB represents a risk-free overnight investment. Banks won’t lend their reserves in the Federal Funds Market for less than the IORB rate.

There are institutions that have Fed accounts, but do not earn IORB. These institutions are willing to lend at less than the IORB because earning some interest on their reserves is better than earning none. A great example – Federal Home Loan Banks (FHLB), which don’t earn IORB, and thus lend a lot in the Federal Funds Market.

To keep the FFR from falling below the target range, the Fed uses a tool called the Overnight Reverse Repurchase Agreement Facility (ON RRP), which is similar to the IORB, but for those institutions that don’t earn IORB. Institutions – like FHLBs – won’t lend at a rate lower than the ON RRP rate because it is their risk-free overnight rate.

So, the FFR ends up in the target range because the Fed directly controls the rates that dictate the upper (via the IORB) and lower (via the ON RRP) bounds of the target range.

Why is the Fed raising rates now? The “dual mandate” of the Federal Reserve is to promote maximum employment, and stable prices. Inflation, as observed in consumer prices measured by the Consumer Price Index (CPI), were up 7.9% from February 2021 to February 2022. That’s the largest year-over-year increase in 40 years.

One major cause of this current bout of inflation: outsized demand for goods. Personal expenditures on goods are up nearly 25%, which has put enormous pressure on supply chains that were already under major strain as a result of the pandemic. This demand has caused a surge in demand for workers, as companies seek to produce enough goods to sate demand. In short: demand for suppliers and labor markets is too high, resulting in price increases.

By raising the target rate of the FFR, the cost of borrowing money will increase, fewer people and businesses will borrow, demand will decrease, supply chains and labor markets will catch up, and inflation will cool off. At least, that’s the goal.

Things We’ve Been Up To

Spring 2022

Q1 Market Review

Spring 2022

Market Update for the Quarter Ending

Market Update for the Quarter Ending March 31, 2022

Positive March Wraps Shaky Quarter for Markets

Equity markets partially bounced back in March. The S&P 500, Dow Jones Industrial Average (DJIA), and Nasdaq Composite gained 3.71 percent, 2.49 percent, and 3.48 percent, respectively. For the quarter, the S&P 500, DJIA, and Nasdaq Composite lost 4.60 percent, 4.10 percent, and 8.95 percent, respectively.

Per Bloomberg Intelligence, as of March 25, 2022, with 99 percent of companies having reported actual earnings, the average earnings growth rate for the S&P 500 in the fourth quarter was 28.9 percent (above analyst estimates for a 19.8 percent earnings growth rate at the start of earnings season).

Technical factors were mixed at quarter-end. The S&P 500 finished the month above its 200-day moving average; however, the Nasdaq Composite and DJIA both finished the month below trend. The S&P 500 fell below its trendline at the end of February before recovering above trend in March.

International markets were mixed last month but ended the quarter in negative territory. The MSCI EAFE Index gained 0.64 percent in March but declined 5.91 percent for the quarter. The MSCI Emerging Markets Index fell 2.22 percent, capping off a loss of 6.92 percent for the quarter. The MSCI EAFE and MSCI Emerging Markets indices ended the quarter below their respective 200-day moving averages.

The 10-year U.S. Treasury yield started at 1.63 percent, increased to 1.72 percent, then surged to 2.32 percent. Short-term interest rates also experienced upward pressure throughout the quarter, driven by rising expectations for more rate hikes from the Federal Reserve (Fed). The Bloomberg U.S. Aggregate Bond Index dropped 2.78 percent for the month and 5.93 percent for the quarter.

High-yield fixed income also saw declines, with the Bloomberg U.S. Aggregate Corporate High Yield Bond Index down 1.15 percent in March and 4.84 percent for the quarter. High-yield credit spreads started the year at 3.05 percent and reached a high of 4.21 percent in mid-March before retreating to 3.33 percent at quarter-end.

Risks Change During Quarter

We saw risks to economic recovery and markets shift throughout the quarter. Declining medical risks were offset by more aggressive plans from the Fed to tighten monetary policy as well as uncertainty created by the Russian invasion of Ukraine.

Medical risks fell during the quarter when the impact from the Omicron variant peaked in mid-January before swiftly declining by quarter-end, with average daily new cases at their lowest level since last July. While additional future waves of Covid-19 are possible, the recent muted economic impact from Omicron highlights an increased ability for the economy to withstand periods of high case growth.

While we’ve made progress in controlling pandemic-related medical risks, we saw rising risks in other areas that negatively impacted markets during the month and quarter. Inflation remains high, driven by high levels of demand and supply chain shortages. Inflation levels caused the Fed to hike interest rates at their March meeting, marking the first hike since 2018.

Geopolitical risks increased during the quarter, most notably surrounding Europe following the Russian invasion of Ukraine. While immediate economic impact to the U.S. has been limited, invasion-induced uncertainty negatively impacted markets.

Economic Momentum Continues Despite Risks

Despite the shifting quarterly risk profile, economic data releases in March showed continued economic growth with last year’s positive momentum carried over. The March job report showed 431,000 jobs were added during the month, contributing to more than 1.68 million jobs created during the quarter. This impressive hiring growth helped drive the unemployment rate to a 2-year low of 3.6 percent by the end of March, signaling a strong labor market that has helped drive overall growth to start the year.

Consumer spending increased in January and February, which was an encouraging sign that consumers remain willing and able to spend. Retail sales growth was especially impressive as sales increased 4.9 percent in January and another 0.3 percent in February.

Business confidence and spending also held up well despite rising quarterly risks. Manufacturing and service sector confidence remained in healthy expansionary territory throughout the quarter. Output also showed signs of recovery, as seen by the 1.2 percent increase in manufacturing production in February.

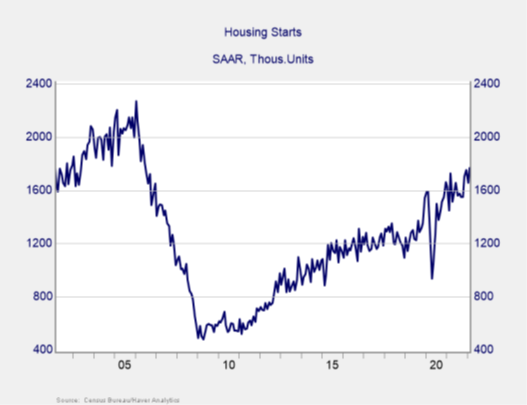

New home construction was impressive, supported by high levels of demand for housing and a shortage of existing homes for sale. As shown in Figure 1, the pace of new home construction hit its highest level since 2006 in February. The housing sector has been a bright spot in economic recovery.

Figure 1. Housing Starts, April 2002–Present

Continued Growth Expected

The first quarter served as a reminder that real risks remain despite solid medical and economic progress. The expectation for tighter monetary policy will likely continue to weigh on markets, and uncertainty from the Russian invasion of Ukraine could lead to further market selloffs if the conflict worsens.

March reports showed the economy remains on solid footing despite shifting risks. We remain in a healthy place, with impressive labor market recovery over the past two years. Businesses have shown they’re capable of operating despite headwinds created by rising rates and geopolitical uncertainty.

While negative headlines and shifting risks may lead to further short-term turbulence, strong fundamentals and continued economic recovery should help long term. Given the potential for short-term selloffs, a well-diversified portfolio that matches investor timelines with goals remains the best path forward for most. If concerns remain, reach out to your financial advisor to discuss your financial plans.

All information according to Bloomberg, unless stated otherwise.

Moore Wealth

Spring 2022

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Moore Wealth is located at 50 Carroll Creek Way, Suite 335, Frederick, MD 21701 and can be reached at 301.631.1207. Securities and Advisory Services offered through Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Advisor.

This communication strictly intended for individuals residing in the states of CA, CO, DC, DE, FL, MD, MN, NC, NJ PA, TN, UT, VA, VT, WA, WV. No offers may be made or accepted from any resident outside these states due to various state regulations and registration requirements regarding investment products and services. Investments are not FDIC- or NCUA-insured, are not guaranteed by a bank/financial institution, and are subject to risks, including possible loss of the principal invested. Securities and advisory services offered through Commonwealth Financial Network®, Member www.FINRA.org, www.SIPC.org, a Registered Investment Advisor. This material has been provided for general informational purposes only and does not constitute financial, tax, or legal advice. Please consult a qualified professional regarding your specific needs.© 2020 Commonwealth Financial Network® Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, manager, fixed income, at Commonwealth Financial Network®.

© 2022 Commonwealth Financial Network®