Financially Speaking

Happy Spring,

These past few weeks have been especially joyful for our family. On February 24th Sean and Lucy’s son Donovan Ennis Moore was born. Please indulge a new grandmother as I share a few pictures with you.![]() For those of you who have known me a long time, you know that I always said I would not be the babysitting grandmother—I would be the fun grandmother. Well, those are not mutually exclusive! I could hold that sweet little boy in my arms all the time. To be clear, I fully intend to spoil and indulge him. We have books to read, music to dance to, places to visit, trouble to get into and mountains to ski! (Ok, I’ll let him grow a bit before we hit the mountains)

For those of you who have known me a long time, you know that I always said I would not be the babysitting grandmother—I would be the fun grandmother. Well, those are not mutually exclusive! I could hold that sweet little boy in my arms all the time. To be clear, I fully intend to spoil and indulge him. We have books to read, music to dance to, places to visit, trouble to get into and mountains to ski! (Ok, I’ll let him grow a bit before we hit the mountains)

In addition to the pictures of Donovan, in this issue you will find our quarterly market update, an article about Female Breadwinners, Erik’s article about Paying Taxes and Michael’s article about Loud Budgeting.

This summer we are excited to let you know that we will be hosting an event for our Clients and their families! Keep an eye out for your invitation to join us in the Mattress Warehouse box for a Keys Game on Friday July 26th complete with fireworks.

Market Update - QUarter Ending March 31, 2024

By Moore Wealth

Quick Hits

- Strong Start to the Year for Stocks

A positive March for stocks caps off a solid first quarter. - Mixed Quarter for Bonds

Bond returns were mixed due to rising rates in the quarter. - Healthy Economic Growth

First-quarter economic reports show signs of healthy growth. - Inflation and the Federal Reserve

Stubbornly high inflation caused the Fed to leave rates unchanged. - Market Risks Worth Monitoring

Geopolitical, domestic, and unknown risks remain for markets. - Despite the Risks, Outlook Remains Positive

The positive economic backdrop and improving fundamentals should support markets.

Strong Start to the Year for Stocks

It was a positive March for stocks, capping off a strong quarter to start the year. The S&P 500 gained 3.22 percent in March and an impressive 10.56 percent in the first quarter. The Dow Jones Industrial Average was up 2.21 percent during the month and 6.14 percent for the quarter. The Nasdaq Composite lagged its peers during the month but still had a strong start to the year, with a 1.85 percent gain in March and a 9.31 percent rise for the quarter. Improving fundamentals and a healthy economic backdrop helped drive the gains in the first quarter.

Per Bloomberg Intelligence, as of March 29 with all companies having reported earnings, the average earnings growth rate for the S&P 500 in the fourth quarter was 8.3 percent. This is notably higher than analyst estimates at the start of earning’s season for a more modest 1.2 percent increase. The better- than-expected earnings growth was widespread with 10 of the 11 sectors coming in above analyst estimates. Over the long run fundamentals drive market performance, so the impressive earnings growth was a good sign for investors.

Technical factors were also supportive during the month and quarter. All three major U.S. indices spent the entire quarter above their respective 200-day moving average. The 200-day moving average is a widely monitored technical indicator as sustained breaks above or below this level can signal shifting investor sentiment for an index. The continued technical support throughout the quarter was another welcome development for investors at the start of the year.

Results were similar, albeit a bit more muted, for international equities. The MSCI EAFE Index gained 3.29 percent in March and 5.78 percent for the quarter. The MSCI Emerging Markets Index rose 2.52 percent in March, but weakness to start the year held back quarterly results for emerging markets as the index only gained 2.44 percent for the quarter. Technical results were mixed for international stocks, as the MSCI EAFE Index spent the entire quarter above its 200-day moving average, while the MSCI Emerging Markets Index briefly fell below trend at the end of January before rebounding above its trendline for the rest of the quarter.

Mixed Quarter for Bonds

While equities had a largely positive start to the year, results were more mixed for fixed-income investors. Rising interest rates throughout the quarter weighed on bond prices, leading to a choppy ride for fixed- income markets. The 10-year U.S. Treasury Yield rose from 3.95 percent at the start of the year to 4.20 percent at the end of the quarter. The Bloomberg U.S. Aggregate Bond Index managed to notch a solid 0.92 percent gain in March, but the index was still down 0.78 percent for the quarter.

High-yield fixed income, which is typically less sensitive to changing interest rates, held up better during the month and quarter. The Bloomberg U.S. Corporate High Yield Index gained 1.18 percent in March and 1.47 percent for the quarter. High-yield credit spreads started the year at 3.54 percent and ended March at 3.12 percent. Falling credit spreads are a sign that investors became more willing to invest in the relatively riskier portions of the fixed income market during the quarter.

Healthy Economic Growth

The economic updates released throughout the quarter showed signs of healthy economic growth to start the year. Hiring accelerated at the end of 2023 and the momentum has carried into 2024, as more than 500,000 jobs were added between January and February. This strong job growth helped support continued personal income and spending growth, with personal spending rising in February at the fastest monthly pace in over a year.

Business spending also rebounded in February, following a Boeing-related slowdown in aircraft orders in January. Core durable goods orders, which strip out the impact of volatile transportation orders, also rebounded well in February after falling in January. This improvement was driven in part by improving manufacturer confidence and supportive service sector confidence to start the year. The improvement in manufacturer confidence was especially encouraging as the ISM Manufacturing Index rose into expansionary territory for the first time since 2022, in March.

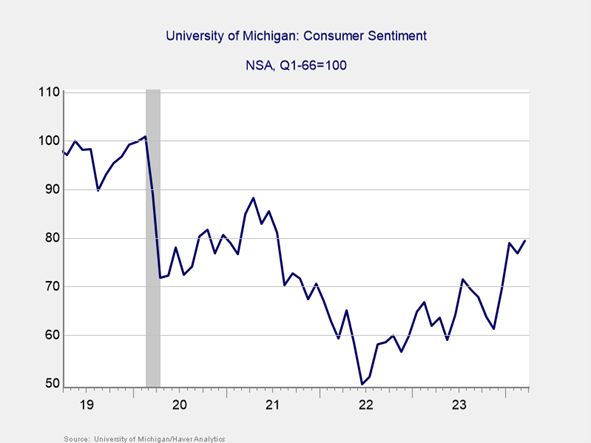

We also saw improving consumer sentiment during the quarter, which is a good sign for future consumer spending growth. As you can see in Figure 1 below, the University of Michigan Consumer Sentiment Index ended March at its highest level in over two years. Improved consumer views on current economic conditions as well as future expectations helped power the improvement in sentiment that we saw throughout the quarter.

Figure 1. University of Michigan Consumer Sentiment Survey, March 2019-Present

The Takeaway

– Economic growth continued throughout the quarter, with hiring growth leading the way.

– Consumer and business spending came in strong in February.

– Improving consumer and manufacturing sentiment to start the year is a good sign for future spending growth.

Inflation and the Federal Reserve

While the strong economic growth to start the year was largely welcome for investors and economists, one downside of the better-than-expected growth was that it helped keep inflation stubbornly high during the quarter. We ended February with both headline and core inflation still well above the Fed’s 2 percent target. Additionally, it appears the progress we saw in late 2022 and throughout much of 2023 in getting inflation down has started to slow, with headline and core inflation only seeing modest improvements in the first quarter.

Given the still high levels of inflation, the Fed left rates unchanged at both their January and March meetings. Fed chair Jerome Powell reiterated the Central Bank’s commitment to getting inflation back down to 2 percent at the Fed’s March meeting and markets have adjusted their expectations for the Fed throughout the start of the year.

We entered the year with futures market pricing in roughly six interest rate cuts throughout the course of 2024, with markets calling for the first rate cut in March. Since then, we’ve seen job growth remain resilient while inflation has remained high, causing markets to pare back their expectations to be more in line with the three rate cuts the Fed expects by the end of the year. While these repriced expectations weighed on bonds to start the year, they should help keep volatility in check going forward provided we don’t see a further rise in inflation.

The Takeaway

- Inflation remains high, with headline and core price growth still above the Fed’s 2 percent target.

- The Fed left rates unchanged at its January and March meetings.

- Market expectations for rate cuts this year have dropped from six at the start of the year to three at the end of March, which is in line with current Fed guidance.

Market Risks Worth Monitoring

While a healthy economic backdrop and improving fundamentals helped propel markets to new highs in the first quarter, real risks remain for investors. The ongoing conflicts in Ukraine and the Middle East are one such risk. While the direct market impact from these clashes has remained muted, they have the potential to snarl already tangled global supply chains and drive further inflationary pressure, especially if hostilities escalate in these volatile regions.

Domestically the largest market risk is a potential reacceleration in inflation. While investors and markets have done well to lower their expectations for rate cuts this year, a sustained uptick in inflation could cause the Fed to wait until we see further improvement on the inflation front before cutting rates. The upcoming election in November is also a worth watching, as it will likely serve to drive uncertainty later in the year.

Other risks to monitor include a slowdown in China, relatively high valuations for U.S. stocks, and rising investor complacency. As always, the potential for unknown risks to negatively impact markets remains. As we saw last month with the destruction of the Francis Scott Key Bridge in Baltimore, external events can rear up at any time and place, with the potential to drive short-term uncertainty.

The Takeaway

- Risks remain for markets, including geopolitical risks in Ukraine and the Middle east.

- Domestic risks include a potential reacceleration in inflation as well as the elections at year-end.

- Unknown risks can also negatively impact markets and can’t be predicted.

Despite the Risks, Outlook Remains Positive

While it’s important to acknowledge the current market risks, overall we remain in a relatively good situation with a positive outlook for the months ahead.

The economic backdrop remains largely supportive, powered by a resilient job market that in turn helps drive improved consumer and business activity. U.S. companies have shown an impressive ability to grow earnings and analysts expect to see continued earnings growth ahead. Markets have now readjusted their expectations for the Fed throughout the rest of the year, lowering the potential for Fed-driven pullbacks. And finally we’ve seen encouraging signs that the economic and market momentum from the end of 2023 has carried over into 2024.

Ultimately, things are pretty good right now, but that is not always going to be the case. While continued economic growth and market appreciation remain the most likely path forward, we may face short-term setbacks along the way. Given the potential for short-term uncertainty, a well-diversified portfolio that aligns investor goals with timelines remains the best path forward for most, although if concerns remain you should speak to your advisor to discuss your financial plan.

Financial Tips for Female Breadwinners

By Shabri

Women often face unique financial challenges that may not affect their male counterparts, yet many women—even high earners—are hesitant to take the lead when it comes to managing their personal and family finances.

An increasing number of women are becoming primary breadwinners in their households, so one might assume women are also taking on most of the financial decisions. On the contrary, most women in heterosexual relationships who are earning more of the household income aren’t making the major money-related decisions for the family. So, why doesn’t earning power naturally lead to financial decision-making power?

- Traditional gender Women may feel less comfortable managing the family finances, and men may feel that responsibility comes more naturally to them simply because of stereotypical gender roles.

- Work-life balance. Time constraints may also deter women from taking control of family. Between childcare, elder care, housework, and career demands, time to devote to money matters may be scarce. Having your spouse take finances off your full plate can seem helpful, but it may be detrimental in the long run.

- Lack of financial Some women may face challenges related to financial literacy. A lack of knowledge about investment, savings, and retirement planning can make it difficult and less appealing to become involved in financial decision-making.

While these reasons might all play into women’s lack of involvement in family finances, it’s critical for women to be in the know about where their money is going. Why? Women are often paid less than their male counterparts, which makes it more challenging for them to save for the future and achieve financial stability. Women are also more likely to take career breaks or work part-time to care for children or elderly parents, which comes with its own financial responsibilities. This can result in lower income and less retirement savings. Finally, women tend to outlive men, which means they need to save more for retirement and plan for a longer lifespan. For all these reasons, female breadwinners should budget strategically, prioritize their retirement planning, and plan for unexpected expenses and emergencies, such as medical bills or home repairs. To manage your finances more effectively and help you achieve your long-term goals, follow these tips for female breadwinners.

Tips to Take Charge

Communicate openly. Establishing open communication with your partner about financial goals, responsibilities, and expectations is key. This might also include redistributing household responsibilities—either to your partner or to an outside person or service—to allow more time for you to help manage your family’s money. Consider planning a date night to discuss your finances to help diminish any relationship tension around the subject.

Compile important information. As part of your communication with your partner about finances, it will be helpful to gather all your account numbers, names of financial institutions, location of assets, passwords, and important contacts such as attorneys and CPAs in one place. You should have hard and digital copies and your trusted family members should know where they’re located. In the event one of you passes unexpectedly, having this will make a difficult situation slightly less complicated to navigate. Ask your financial advisor if they have a template for this type of document that requires you to just fill in the blanks.

Create a budget. This will help you track your income and expenses, identify areas where you can cut back, and plan for the future. Start by listing all your monthly income and expenses, including bills, groceries, and other necessities. Having a clear sense of where your money is going will help you identify areas for improvement and is the first step toward becoming more involved in managing your family’s finances.

Save for retirement. Women need to save a larger percentage of their income for retirement than men just to end up at the same level of wealth. This is because women often take time out of the workforce, make less money than men, and live longer on average. So, retirement planning is crucial, especially if you’re the primary breadwinner. Make sure you’re contributing enough to your retirement accounts, such as 401(k)s or IRAs, and consider working with a financial advisor to determine the best investments for your goals.

Start an emergency fund. There’s always a chance you may face unexpected expenses, such as medical bills or home repairs. Having a financial safety net can alleviate stress, avoid a financial challenge, and provide a sense of security.

Purchase insurance. Ensure that you and your family have adequate coverage, including health, life, and disability insurance. These protect against unexpected events that could jeopardize your family’s financial stability.

Get your estate documents in order. In addition to a fund for emergencies and setting up insurance coverage, you’ll want to plan for your family’s future in case something happens to you. It’s advisable to consult with a qualified attorney about your specific situation and unique goals. Core estate planning documents generally include:

- Durable power of attorney (POA) for financial matters

- Health care POA (and/or a living will)

- Will

- Trust agreement (depending on your specific situation)

You’ll also want to update your beneficiary designations. Outdated beneficiary designations can derail an estate plan. Review your designations periodically to ensure that the correct people are named and are still appropriate.

Learn about personal finance. If you feel a lack of confidence in making financial decisions, attend workshops, read books, or consult with our team at Moore Wealth to enhance your understanding of investments, retirement planning, and other financial instruments. Better understanding will lead to a greater sense of comfort in managing your money.

Call us for a consultation. The advisors at Moore Wealth can help you in various ways, such as informing you about tax breaks or credits you might not have known about, choosing investments based on your risk comfort level, and setting up the most beneficial retirement plan for your needs.

As more women take on the role of breadwinners in their families, they face unique financial challenges. With careful planning and management and communication with your partner, you can achieve financial stability and help ensure a secure future for yourself and your loved ones.

Why Paying Taxes is Okay

By Erik

Most people know some version of the saying “nothing is certain in this world except death and taxes”, and most people would attribute that quote to Benjamin Franklin. While the saying is well known, few know that the record of Franklin saying it comes from a letter that he wrote to Jean Baptiste Le Roy in 1789. What is even less known, is that the original quote, “Tis impossible to be sure of any thing but death and taxes”, is from The Cobbler of Preston, an opera written in 1716 by Charles Johnson. While there is a mix-up in who gets the original credit for that quote, there is no confusion with it’s honesty: taxes are inevitable.

Perhaps it is the certainty of taxes that makes everyone hate them so much, or more likely that people just don’t like paying money to the government. From an income tax perspective, this of course makes sense because no one wants to work hard for their money so they can take home a significant amount less than they earned. It is for this reason that CPAs are constantly trying to find ways to reduce their client’s taxable income. While reducing income tax is a non-trivial goal, there is something that people often try to do that is somewhat counterintuitive: reduce capital gains tax.

Conceptually, reducing capital gains taxes would be useful since it means that you are paying less taxes. However, the issue arises in the methods that are available to reduce capital gains tax. The only way to reduce capital gains tax is to either reduce the amount of gains you are realizing, or spread the gains you are realizing over the course of more than one year. In either case, it leaves you in a place where you may have less money gained from the sale of your investments.

The whole point of investing money is for that money to grow over time, but the actual growth of that investment is not earned until it is sold to realize the gain. Too often, people will hold on to an investment for a very long period of time and never sell a portion of it. For the most part, this is done for two reasons: the thought that the particular investment has been performing well, and therefore will continue to do so; or that the gain is so large that the taxes associated with the sale are too high. In both of those cases, the thought process is incorrect more often than not.

Ideally, any growth in a singular investment should be viewed as potential dollars. Those potential dollars are worth the growth seen minus taxes, and become yours once you sell the investment and pay those taxes. Everyone likes to see large green numbers in the gain/loss column of their account statement, but by adapting a new mindset that the green is not yours until sold, creates a better environment for dealing with taxes. This doesn’t mean that any investment should be completely sold at any given point, but does mean that gains should be strategically harvested so as to lock in the growth. One of the easiest ways to do this within a diversified portfolio is to simply periodically rebalance your allocation.

Through a brief history lesson, and longer capital gains lesson, it’s been a roundabout discussion to get back to why paying taxes is okay. Ultimately, there is one reason: you either pay taxes and have more money, or pay less taxes and have less money. At Moore Wealth, our job is to plan for our client’s futures, and effectively manage their money to more easily facilitate their goals. When we can create a larger pool of assets by paying taxes on efficiently realized gains, we can make those goals less stressful and easier to attain. With that in mind, rather than fearing taxes, embrace the fact that you have more money once those taxes are paid.

“Loud Budgeting”: A Long-Term Way to Budget or Another Online Trend?

By Michael

Loud budgeting is the newest online trend when it comes to finances. It consists of not shying away from setting financial boundaries with family and friends (and in some cases, the whole internet). Instead of throwing the budget out the window for a spur-of-the-moment trip or concert, people are pushing back and being vocal about their financial boundaries. While this can lead to some uncomfortable conversations and missed events, those who participate in Loud Budgeting are prioritizing the bigger purchases in life such as a new car, a down payment for a house or retirement over a night out and weekend trips.

While many people push back saying loud budgeters are cheap, many are joining in on the social media trend. It is mostly used by Gen Z and Millennials who want to set clear boundaries for everyone around them.

This is not a “look-at-me” trend, but a lifestyle change that can be useful for the younger generations who are looking to save for their futures. Young professionals entering the workforce go from full-time students to full-time employees overnight. With full-time employment comes full-time paychecks. This can seem overwhelming for many young people just starting in the workforce. With a full-time income, they start spending and become stuck with thin margins to get through the month. Loud budgeting gives young professionals a more comfortable way to talk about their finances with those around them.

Loud budgeting also encourages accountability and reduces the stigma around personal finances. With those close to you having some level of insight into your budget and long-term goals, you can have more candid and open conversations with those around you instead of trying to make large financial choices alone. Now, this is not a go-ahead to tell everyone you meet every detail of your finances, but it can make having conversations around money easier for all involved. This can lead to more growth for the individual as well as everyone in their circle who understands their personal financial boundaries for the short term and long term.

Author Nathan Morris says that “The speed of your success is limited only by your dedication and what you’re willing to sacrifice.” This quote exemplifies what it means to be a loud budgeter. Those who are willing to limit themselves now to secure a strong financial future and clarity with finances fit this quote.

At Moore Wealth, we understand your financial goals and boundaries, but not everyone does; and setting boundaries with money is difficult but necessary. While loud budgeting may not be for everyone, it is something to consider with those around you, especially teenagers and young adults as they step into adulthood and beyond. We want to be a “tool in your toolbelt” when it comes to your financial future!

Moore Wealth

Disclosure: This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.

Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad- based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non- investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Advisory services offered through Moore Wealth®, a Registered Investment Adviser. Moore Wealth is located at 50 Carrol Creek Way, Suite 335, Frederick MD 21701. They can be reached at 301-631-1207.

Authored by Brad McMillan, CFA®, managing principal, chief investment officer, and Sam Millette, director, fixed income, at Commonwealth Financial Network®.

© 2024 Commonwealth Financial Network