Financially Speaking

From Shabri

“Always remember you matter, you’re important and you are loved, and you bring to this world things no one else can”. The Boy, the mole, the fox and the Horse by Charlie Mackesy.

I think that is such a great message for any time of year, but especially now. For me, spring signifies a time to renew, reflect and have the opportunity to refresh your mind, your body and your soul. At first glance, I thought Mackesy had written a children’s book. As I turned the pages, I realized this is a book for all of us, no matter how young or old you are.

At its core, it is a story about kindness and understanding as told through conversations between the four main characters in the title. “All four characters represent different parts of the same person,” explained Mackesy, “the inquisitive boy, the mole who’s enthusiastic but a bit greedy, the fox who’s been hurt so is withdrawn from life, slow to trust but wants to be part of things, and the horse who’s the wisest bit, the deepest part of you, the soul …”

The book is a quick read, and yet, the messages that Mackesy conveys are powerful. Be kind to yourself and to others, forgive yourself, spend more time listening to your dreams than your fears, take care of the beauty all around you, everyone gets scared but being together makes you less scared, understand that asking for help is not giving up but rather it is refusing to give up, be curious, life is not perfect and so many more lessons can be found in this delightful little book.

Mackesy was quoted as saying ‘We don’t have to pretend. We’re all the same, really. I think real closeness comes from vulnerability and the book is a journey into closeness and honesty.” I would agree. I’ll leave you with my favorite quote and sketch from The Boy, the mole, the fox and the Horse.

Your Portfolio

Quarter Ending March 31, 2023

From Sean Moore

“Passive Income” – Not as Passive as it Seems

A common discussion that we have with clients – perhaps even more often with friends and acquaintances – revolves around the idea of “passive income.” The concept has become pervasive over the last years, driven largely by social media influencers who put themselves out as “financial coaches.” As with anything else that seems too good to be true, the realities of “passive income” are not as straightforward as the influencers would lead you to believe. In this article, I’ll discuss a few considerations that should make you think twice about whether or not passive income is an appropriate part of your financial plan.

The most compelling argument in favor of passive income is in the name: it’s passive. The idea is that once you’ve made your initial investment, you don’t need to do anything to earn it. Who doesn’t like the idea of getting something for nothing? When you consider the logistics of one of the most popular passive income sources – short-term rentals such as offered via Airbnb or VRBO – it becomes clear that this income is anything but passive. Guests need to be found and booked, accommodations need to be cleaned and prepared, and issues need to be addressed. None of the activities involved in managing a short-term rental are zero-effort, let alone zero-cost. You could always hire a property management company, but this will quickly cut into your bottom line, and you’ll still have to keep tabs on the work they’re doing on your behalf.

The second compelling argument in favor of passive income is the rest of the name: income. To continue with short-term rental example, the idea is that you’ll be generating a steady stream of income from your renters, which means money in your pocket on a regular basis. The first issue here is the assumption that you’ll see occupancy – and therefore revenues – sufficient to generate a profit. If you see occupancy below expected rate, will that revenue be enough to cover your costs (mortgage, utilities, services, maintenance), let alone leave something for you to keep? The second issue with income is a tax issue. Income is taxed at income tax rates, which are currently greater than capital gains rates, except for the lowest marginal brackets. As an example, if you are in the 24% marginal tax bracket, every dollar of additional income you earn will really translate into $0.76 that you get to keep. This is before accounting for state income tax, which will further cut into that total.

A further argument against passive income investments is an argument in favor of diversification. To once again use the short-term rental example, let’s assume you purchase a property to be used for this purpose at a price of $500,00 but take out a mortage so that you put down $100,000. I would wager that if I told you that I thought it would be prudent to invest $100,00 in a single stock, and that this stock would incur a holding fee (mortgage payment) of roughly $2,700 per month, you would – at a minimum – have some questions for me. More likely you would be asking that we explore other options.

Strategies like owning rental property can be valuable components of a sound financial plan. The idea that “passive income” is a realistic means to financial independence is questionable at best. If you are interested in discussing whether your financial plan is structured to effectively and efficiently achieve your goals, please do not hesitate to call or email the team.

Quarter Ending March 31, 2023

From Erik Moore

Simply put, the dollar can’t collapse in the short to medium term. Why not? Let’s imagine a hypothetical scenario, Suppose I told you that Amazon would collapse this year, and people would abandon it to flock to other merchants, like Walmart, for example. That seems somewhat plausible because Walmart is indeed a valid competitor, is spending a lot of money to take business from Amazon and has the scale to do so credibly. That logic creates a good case that Amazon is going to collapse.

But when you think about it, the idea is a bit silly. For the millions of people who have an Amazon Prime account and multiple preset orders, who watch Prime Video, and so on, it would be a lot of work and a major inconvenience to switch. Even if Walmart offered a full range of competitive services, it’s unlikely that tens of millions of people would suddenly collapse simply isn’t credible.

In our parallel scenario, the U.S. dollar is Amazon, and the Chinese yuan is Walmart. Yes, China would like to dethrone the dollar, but it isn’t that simple. As long as the U.S. is the largest open trading economy, everyone in the world wants access to the U.S. economy, and it would create a lot of work and a great inconvenience to switch, the position of the dollar as the global reserve currency is secure.

No Other Choice

China itself holds more than $1 trillion-with a T-worth of assets. Why? When it sells things to the U.S., it gets paid in dollars. China must then invest those dollars. And since there are so many of them, the only real option is U.S. Treasury securities. So, even China is locked into not only taking, but holding, U.S. dollars. if China is still on the hook, and if Walmart is still doing business with Amazon, will Amazon really collapse?

But wait, there’s more. So far, we’ve assumed there is a real alternative to the dollar, but there isn’t. Three things make the dollar special: First, the sheer size of the U.S. economy. The only other currencies that even come close are the yuan and the euro. Second, the freely convertible nature of the dollar. The yuan’s exchange rate is determined by the Chinese government, not the market, which makes it very risky from a political perspective. That leaves only the euro as an option. And the final factor is the relative political and economic stability of the U.S. compared with Europe and China. When you look at all those pieces, the U.S. dollar is not only the established choice – and, in most cases, the smart choice – but the only choice. There really is no alternative.

Why the Buzz?

Frankly, all of the talk of a collapse is nonsense designed to panic you into buying something the doomsters are trying to sell, often gold. This is a fad that has come and gone every year or two for at least the past decade. It wasn’t true in the past, and it isn’t true now.

Here’s more evidence: The dollar is now trading at just about the same level against other currencies as it has for the past several decades. It goes up and down, but we are still in the middle of the range. In terms, of the markets, the dollar is still where it has always been. If we consider the markets as a warning system, they are still flashing green. When they start to turn yellow or red, that will be the time to worry – not now.

More Panic Memes Debunked

The dollar’s hypotehtical collapse isn’t the only topic in our newsfeeds causing worry. Let’s examine some others:

- The collapse of the banking system. Although this one originated with the collapse of Silicon Valley Bank, you’ll notice that we haven’t seen any more bank failures in recent headlines. The government took the necessary steps to contain the problem, and here we are with no headlines. A good lesson for the rest of the list here.

- De-dollarization. As discussed above, the data shows this simply isn’t happening. The dollar remains reasonably strong, countries continue to want to sell to the U.S., and in almost all cases, there really isn’t an alternative. This also applies to the petrodollar headlines, which come up every few years but aren’t true.

• The Federal Reserve’s (Fed’s) negative cash flow. This concern stemmed from the panic about the banking crisis (which, as noted, isn’t a reason to panic) and poses the question, “Can the Fed go bankrupt?” The answer is no. According to Sam Millette, director of fixed income at

Commonwealth, “The Fed was not created to generate profits, and this has never been a

requirement. The central bank operates to promote maximum employment and stable prices.

While, historically, it has been able to generate profits that have been remitted to the Treasury,

this is not a requirement or even a formal goal for the Fed. The Fed is not a commercial bank that can suffer from depositor runs, and there is no risk of default.” In addition, it’s hard to go bankrupt when you can create money, which the Fed can.

• Central bank digital currencies. Speaking of creating money, the Fed is now exploring the notion of an official digital currency, and the scare headlines say this will replace the dollar and enable the government to surveil and/or confiscate people’s savings. The Fed is indeed looking at this notion but not with any sense of urgency. If the central bank does it, it won’t make much of a difference because most money is essentially digital now. When was the last time you paid your mortgage with cash? Do you use a debit card? This won’t happen in the short to medium term, but even if/when it does, it won’t make any more of a difference than switching from cash to credit/debit cards did. As for the risk of confiscation, an official digital currency wouldn’t make this risk any greater than it is now—and it won’t happen now either. This may remind you of the great 401(k) confiscation scare of a couple of years ago, which never happened.

The common theme is that some headlines take a real fact or trend and exaggerate it to scare people. Often, when you look back, you see this happening regularly every few years. Many people creating the

buzz are trying to sell you something, not inform you. When you keep that in mind, it’s easier to stay unaffected by these headlines.

Are there things to worry about? Certainly, but they are generally large scale and slow moving. The good thing about them is we can track the data and see when we are getting into trouble. If we are tracking the

problem, we usually can avoid it. We can’t always dodge trouble, of course, but there are tools available, like in the recent banking “crisis,” that can help limit or resolve the issue. There’s rarely a headline that warrants real panic. And that is the answer to these and similar headlines.

Quarter Ending March 31, 2023

Market Update for the Quarter Ending

Market Update for the Quarter Ending March 31, 2023

Markets Rebound in March

Markets had a solid March, as a month-end rally helped bring all three major U.S. indices into positive territory for the month. The S&P 500 gained 3.67 percent while the Dow Jones Industrial Average (DJIA) increased 2.08 percent and the Nasdaq Composite notched a 6.78 percent gain. March results helped offset weakness in February and all three indices ended the quarter in the green. The S&P 500, DJIA, and Nasdaq gained 7.50 percent, 0.93 percent, and 17.05 percent, respectively, for the quarter.

These positive results came despite slowing fundamentals. Per Bloomberg intelligence, the S&P 500 average earnings decline was 2.38 percent during the fourth quarter of 2022. While this result was marginally better than the 3.26 percent decline expected at the start of earnings season, it marks the first quarter with a year-over-year decline since the Covid-19 lockdown-impacted third quarter of 2020.

Fundamentals drive long-term market performance, so the earnings decline should be monitored.

Unlike fundamental factors, technical factors were supportive for the quarter. All three major indices finished March above their respective 200-day moving averages, marking three consecutive months above trend.

International equities had a similar month to the U.S. The MSCI EAFE Index and MSCI Emerging Markets Index gained 2.48 percent and 3.07 percent, respectively. For the quarter, the MSCI EAFE gained

8.47 percent while the MSCI Emerging Markets Index gained 4.02 percent. Technical factors were also supportive for international markets with both indices finishing March above their 200-day moving averages.

Strong March for Fixed Income

Fixed income markets also experienced positive returns as falling rates supported bond investors in March. The 10-year U.S. Treasury yield fell from 4.01 percent at the start of the month to 3.48 percent at month-end. The notable drop in yields was due to increased investor demand for higher-quality fixed income due to rising concerns over the health of the banking sector. The Bloomberg Aggregate Bond Index gained 2.54 percent during the month, which contributed to the index’s quarterly return of 2.96 percent.

High-yield fixed income also had a positive month and quarter. The Bloomberg U.S. Corporate High Yield Index gained 1.07 percent during the month and 3.57 percent for the quarter. After experiencing some volatility the past three months, high-yield credit spreads ended the quarter in line with where they started this year.

Returns to highlight on this page

- Bloomberg Aggregate Bond Index: 2.54 percent in March, 2.96 percent for the quarter

- Bloomberg U.S. Corporate High Yield Index: 1.07 percent in March, 3.57 percent for the quarter

Bank Stress Worries Markets

The high-profile banking failures at Silicon Valley Bank, Signature Bank, and Silvergate Bank garnered headlines and captured investor interest in March. The initial market reaction to the bank failures was a flight-to-quality trade. Riskier assets like stocks and high-yield bonds sold off while higher-quality fixed income sectors saw yields fall and prices rise.

While regulators and insurers stepped in to ensure that depositors at these banks did not lose their deposits, the Federal Reserve (Fed) and U.S. Treasury also made capital available to other banks to reassure Americans that the banking system as a whole was healthy. The initial uncertainty caused by the bank collapses are a reminder to investors that market risks can appear at any time.

The banking turmoil in March created uncertainty and volatility, but the issues that led to the collapses appear to have been largely constrained to a handful of banks rather than a sign of systemic weakness in the banking system.

While bank health will certainly be worth monitoring in the months ahead given the Fed’s continued attempts to combat inflation through tighter monetary policy, banking system risks for investors appear to be largely behind us.

The Takeaway

- Concerns about the banking sector took center stage in

- While initial uncertainty led to an initial sell-off for risk assets early in the month, markets have since recovered as regulators and insurers stepped in to support the banking industry.

Economic Updates Positive

Despite the mid-month market turbulence caused by strain on the banking industry, economic updates released in March continued to show positive signs of growth. The February employment report displayed strong job growth, which is an encouraging sign that the labor market remains in healthy territory.

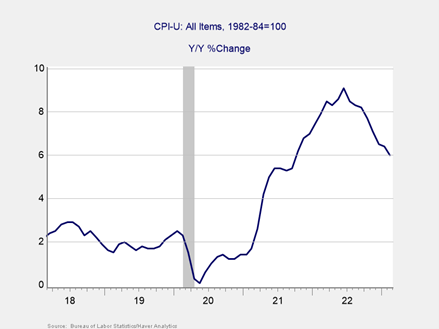

We saw continued evidence that the Fed’s attempts to combat inflation are working. As you can see in Figure 1, the year-over-year change for the Consumer Price Index fell to 6 percent in February, which is down notably from the high of 9 percent that we saw in June 2022.

While there is still work to be done to get inflation back closer to the Fed’s targeted 2 percent range, the progress that we’ve seen since peaking last summer is encouraging and signals that we’re on the right path.

Figure 1. Year-Over-Year Percentage Change in Consumer Price Index, All Urban Consumers, March 2018-February 2023

Risk Worth Monitoring

Banking-driven uncertainty in March served as a reminder that very real risks remain for markets and investors. While the worst impact from banking industry stress appears to be behind us at this time, news of additional bank weakness could lead to further sell-offs in the future. The banking system struggles also highlight the uncertainty that the Fed represents for markets and the economy, as the central bank’s attempts to fight inflation through tighter monetary policy placed pressure on banks.

Concerns about the debt ceiling and a government default linger as we get closer to a potential default in the summer or early fall. The continued housing sector slowdown also represents a possible risk for markets given the sector’s importance for the overall economy.

Looking abroad, China remains a source of uncertainty as the country’s reopening efforts have yet to be fully absorbed by the global economy. There is also potential for additional conflict from the ongoing Russian invasion of Ukraine, and it’s important to remember that unknown risks could negatively impact investors.

The Takeaway

- Banking-induced uncertainty is a reminder of

- The debt ceiling, a slowing housing sector, and international risks are key areas to monitor.

Outlook Still Positive

Despite the mid-month uncertainty, March proved to be positive for investors. While the rise in banking sector risk should be monitored going forward, developments during the month point toward contained risks at a handful of banks rather than systemic cracks in the broader banking system.

The fact that all of the major indices we track in this piece ended the month in positive territory is a good sign that markets are resilient. Additionally, the continued positive economic backdrop should help support markets in the months ahead.

The potential for further short-term uncertainty remains and a well-diversified portfolio that matches investor timelines and goals is the best path forward for most. As always, you should reach out to your financial advisor to discuss your current plan if you have concerns.

The Takeaway

- March was a positive month for markets despite rising

- Risks remain for investors and should be

- The long-term outlook is positive, with potential for short-term setbacks.

Moore Wealth

Quarter Ending March 31, 2023

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Portions of this newsletter authored by Brad McMillian, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, manager, fixed income, at Commonwealth Financial Network®.

Advisory Services offered through Moore Wealth®, a Registered Investment Advisor.

Moore Wealth is located at 50 Carroll Creek Way, Suite 335, Frederick, MD 21701 and can be reached at 301.631.1207.