Financially Speaking

From Shabri

Happy New Year! As we begin 2024, I’d like to take this opportunity to share our Moore Wealth Process that we work through during the course of the year for each of you, our clients. Each component of that process functions in service of your overall Financial Plan. This includes managing your portfolio, tax planning, estate planning, risk management and more. As we work on each area, we will consult with CPAs, Attorneys, and our Advanced Planning teams to build out strategies that are in your best interest. A big part of this process is making sure that we are up to date on current economic conditions, markets, tax law changes, estate law changes and any potential issues that would impact your Financial Plan. In addition to keeping abreast of current literature, we attend educational meetings and webinars regularly.

During your meetings with us we typically provide an economic overview, discussion of your portfolio holdings and performance, and at least once a year a review of your Financial Plan. While we may not discuss everything we have worked on since our last meeting, there is a lot that goes on behind the scenes! The checklist that follows my remarks will give you an idea of the different components of your Financial Plan that we assess during the course of the year.

The Moore Wealth team is growing! Michael Haley recently joined us as a Client Service Associate. Some of you may remember that Michael interned at Moore Wealth a few years ago and we are delighted to have him back as a full-time employee. We will make sure you get to meet him the next time you are in the office.

We hope that you have been enjoying our weekly Top 5 Newsletter of articles that Sean curates, the occasional Sundays with Shabri, and our Quarterly Newsletter. This year we plan to reinstate our Moore After Hours events. Keep an eye out for upcoming educational events as well as “Moore Fun” events.

In this quarter’s newsletter you will find an article about How to Understand Market Indexes written by Erik, an article about Understanding I360 written by Sean and our Quarterly Market Update from Commonwealth Financial Network.

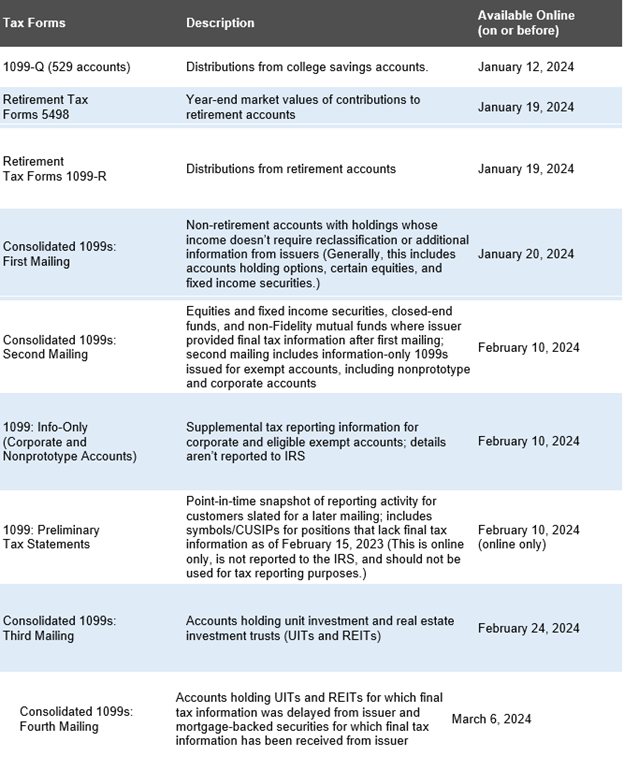

If you are being proactive for tax season, please note that your Tax Documents will be available on the schedule noted in the Tax Form Mailing Dates table that we have shared. Keep in mind that your tax documents are always first available via Investor360.

We look forward to seeing you soon.

INVESTOR 360: MORE THAN JUST ACCOUNT BALANCES

From Sean

As a Moore Wealth client, you have access to Investor360 – your portal to access a wide array of information, reports, and functions related to your finances. We set your account up when you became a client, so you’ve probably gotten into a rhythm with how you access and utilize the platform. With that in mind, this article is intended to highlight a few key features of Investor360 that you might find useful, or that might add to the value the platform provides you.

Add Outside Accounts

A critical part of building and maintaining your financial plan is ensuring that we are using the most up-to-date information possible. While Moore Wealth always has this information for accounts we manage on your behalf, we rely on you to provide us with information for outside accounts – like your employer-sponsored retirement plan, your mortgage, or your bank accounts. Investor360 provides you with two great ways to do this, allowing us to ensure that your plan is as accurate and as possible.

Regardless of which method you utilize to add outside accounts, you do so by clicking the “Add Account” button, located next to the heading “Additional Accounts” on your Investor360 Dashboard, or on the “Portfolio – Holdings” page.

To link an outside account, which will allow the account values to update nightly in Investor360, search for the financial institution that holds the account you want to link. Then click the relevant icon, and walk through the prompts. Investor360 utilizes Evestnet | Yodlee to aggregate information from outside accounts, which will guide you through the setup process by having you log in to the account. You are not providing your login information to any third parties – you are linking the data from your outside account to your Investor360 profile.

To manually enter an account, click the “Add Account Manually” icon. With this option, you will need to select (at minimum): account type, account name, as of date, and description. If you choose to utilize the manual entry method, please keep in mind that it is up to you to ensure that the information entered is accurate.

Send Secure Messages

Maintaining the security of your personal and financial information is of the utmost importance to Moore Wealth. Our internal processes and technology support this, to include the secure messaging function available via Investor360. Investor360 messages is best utilized for sharing sensitive information such as SSNs, full account numbers, or tax information.

Messages looks and operates very much the same as an email account. To send an Investor360 message, navigate to the “Messages” page of your Investor360 profile. Click the “Compose” button, then write a Subject Line and Message Text that will help us know what you’re sending out way. Don’t forget to include any relevant attachments.

Statements & Documents

Like many of you, at Moore Wealth we like to avoid lots of paper (when we can), and we like to have more than one way to access important information. The “Statements & Documents” page of Investor360 can help you do this in a few ways.

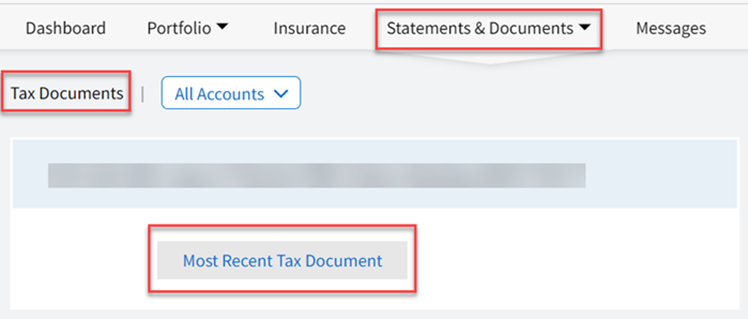

As we enter tax season, you’ll want access to your tax documents as soon as possible. The first place these will be available to you is via the “Statements & Documents – Tax Documents” page of your Investor360 profile. The schedule of availability – included elsewhere in the newsletter – will let you know when you can expect your tax documents to be available. Please note that the “Most Recent Tax Document” button will grant you access to the relevant 2023 document once it becomes available.

A relatively new feature – Document Upload – can be accessed via the “Statements & Documents – Documents” page. This feature allows you to upload documents from your device to your Investor360 profile that are stored there, and which become accessible to the Moore Wealth team. This is a great place to share a digital copy of your Legacy Binder with Moore Wealth!

Investor360 is your portal to access a wide array of information, reports, and functions related to your finances. If you want to learn how to better leverage Investor360, please do not hesitate to reach out the team – we’re happy to help.

Understanding Market Indexes

From Erik

S&P 500, Dow Jones Industrial Average, and Barclays Aggregate Bond are all market indexes that are pretty well known – bare minimum, most people have heard the names before. Each one represents a different basket of investments that can provide information about financial markets as a whole, or can shine light on to specific portions of financial markets. But how are each of these indexes put together, what is each one trying to tell us, and what are the limitations of each of them? Through the remainder of this piece, we’ll be answering those questions, and delving further into market indexes as a whole.

Before getting into the specifics of some of the more well-known indexes, it’s important to know that there are thousands of different market indexes that have been created over the years. Some of them are meant to provide broad information about an entire market, like the Wilshire 5000 which tracks over 99% of the investable universe in the US. Some provide information about more specific areas of a market, like the Morningstar US Healthcare Index which tracks the performance of the US Healthcare Sector and nothing else. Some are put together with equal weighting to each of the holdings, some use a market cap weighted method, others use a stock price weighted method. Ultimately, each index can be different from another in a variety of ways, and understanding those differences is important when it comes to gleaning information from them.

The next thing to understand is the difference in how indexes are weighted. There are 3 main ways that indexes are weighted: price weighted, market cap weighted, and equal weighted.

- Price weighted: Each holding in the index is weighted by the share price as compared to the sum of the parts of the index. As an example, let’s assume stock AAA is worth $5 per share, and is part of an index where the share prices of all the stocks equals $100. Stock AAA would have a 5% weighting in the index. If stock BBB is also in the index, and is worth $8 per share, it would have an 8% weighting in the index.

- Market Cap weighted: Each holding in the index is weighted by the market capitalization of the company as compared to the sum of the parts of the index. Market capitalization is obtained by multiplying the current share price of a stock by the total number of shares of stock that exist. In this case, let’s say stock AAA has a share price of $100, and there are one million shares of the stock that exist. This means it’s market capitalization is $100 million. If that stock were to be in an index where the combined market capitalization is $1 billion, then stock AAA would have a 10% weighting in the index.

- Equal weighted: The simplest of weighting methods, where each stock has the same weighting to the index as all others. If there were 10 stocks in an index, then each stock would have a 10% weighting in the index.

Each of these methods has pros and cons, and none is particularly better than the other. For price weighted indexes, they are simple to put together and understand, but the weightings can be somewhat arbitrary as per share price of a stock isn’t particularly indicative of a company’s total value. For market cap weighted indexes, the holdings are all proportional to the company value, but there can also be too much influence by holdings that are overpriced. Equal weighting is simple and creates even influence amongst the holdings in the index, but the relative change in value of a company is neglected, and a lot of rebalancing needs to be done to keep the weighting equal. Ultimately, all of the different methods have their use, so it’s important to know how the index you are looking at is weighted.

So with this hopefully new knowledge, let’s take a look at some of the commonly used indexes, and how they are put together, how they differ, and how each is limited.

The S&P 500 is composed of the 500 largest companies in the United States based on their market capitalization. Other criteria to be included in the index are minimum volume of shares traded per month, and being listed either on the New York Stock Exchange or Nasdaq. It is not industry specific, and is market capitalization weighted. When people are talking about “the market” they are often referring to the S&P 500. In a lot of instances, it is a good reflection of the United State stock market as a whole. Where it can fall a bit short, however, is when one or a number of the holdings are overpriced. A good example of this is what the index looked like in 2023.

At the beginning of 2023, the top 10 stocks made up 24.89% and the top 5 made up 17.78%. By the end of the year, the top 10 stocks made up 30.85%, and the top 5 made up 22.57%. This created a problem when it comes to the performance of the index, as more than a fifth of the entire index is controlled by 1% of the total number of companies in the index. To illustrate that point further — and if you’re a client of ours, you’ve already heard this – the top 7 stocks in the index made up for over 60% of the total gains in the index for 2023. So while the S&P 500 can be a good gauge of the United States stock market as a whole, there are times where it can be very skewed.

Moving on to the Dow Jones Industrial Average, more simply the Dow, which is made up of 30 stocks in various industries. It is a price weighted index, and the components are selected based upon their contribution to the industry they represent as a whole, and that industry’s contribution to the current trend of the broader US economy. Since it’s inception in 1896 the Dow has become thought of as a proxy for the health of the broader US economy, and remains one of the most watched market indexes in the world. While there is still merit to this index as a representation of the economy, it also has it’s limitations.

First off, the Dow is made up of only 30 stocks. With a US investing universe of around 4000 stocks, an index that represents just 30 stocks doesn’t really show the whole picture. Second, the Dow price weighted index, which means that the size of a company has no bearing on it’s weight within the index, only the price per share does. The companies in the Dow are all very large companies with solid balance sheets, but the difference in the market capitalization of each of the companies can be large. For example, both Microsoft and Home Depot are in the Dow, and each comprises around 6.50% of the index. However, Home Depot has a market capitalization of $360 billion, and Microsoft has a market capitalization of $2.96 trillion. This means that a $1 move in the per share price of Microsoft has a significantly larger impact than a $1 move per share of Home Depot.

Aside from stock indexes, there are also bond market indexes. The most widely used is the Barclays Aggregate Bond Index, known familiarly as the Agg. The Agg is a market capitalization weighted index that is made up of a variety of US based bonds ranging from US Treasuries, to corporate bonds, to mortgage backed bonds, etc. Aside from being US bonds, selection criteria includes a requirement that the bonds are investment grade, at least one year from maturity, and are fixed rate. The Agg is meant to be a representation of the US bond market as a whole, and most of the time it does a good job of representing that market. Like all of the other indexes discussed though, there are situations where it will fall short.

With the Federal Reserve hiking their interest rates very rapidly from 2022 – 2023, the bond market experienced an unprecedented amount of volatility. As bonds that were closer to maturity began to have higher interest rates than their counterparts that were farther from maturity, the whole bond market started to get out of whack. In looking at the performance of the Agg in 2022, which was down just over 13%, one would wonder why they would invest in bonds if they can lose that much in a year. However, the bond market wasn’t in a bad place, it was simply an environment that the Agg wasn’t good at effectively illustrating. The weighting of the bonds in the Agg is pretty heavy towards government bonds, as the market capitalization of government bonds is larger than any of the others. The interest rate set by the Federal Reserve will flow through to the value of government bonds faster than others, so the Agg was skewed to the downside as a result of the weighting of those government bonds. Ultimately, there were still plenty of good bonds to be holding with high interest rates but the index made it appear as if there weren’t.

At the end of the day, market indexes are a great way to get a broad look at a particular group of investments, but only when they’re fully understood. Without looking at the index with the right context, the information that is pulled from it will be flawed. Knowing what the index is trying to represent and how that data is being represented is a good starting point, and will allow you to better understand what particular moves in an index really mean.

Accessing Your Tax FOrm

Accessing Your Tax Form

If you are enrolled in e-notification, you will receive an email notifying you that your tax forms are ready to view. If you are not enrolled in e-notification, your form will be mailed within five business days of online posting.

In both cases, once issued, you may access an electronic version of your tax forms (see screenshot below) in Investor360°® under Statements & Documents > Tax Documents > Most Recent Tax Document

Tax Form Mailing Dates

Our partner, National Financial Services (NFS), will post and mail consolidated 1099 tax forms in four waves, outlined in the table below. The dates below are when your tax form will be available in Investor360°. They will be mailed five to seven days after they are posted online.

Please note: In instances when tax reporting for an account occurs during the extension period, NFS will provide an online preliminary tax statement starting on February 10. This is viewable only in Investor360° and will provide a single view of current tax information to help you determine early tax liability.

If you have questions, please don’t hesitate to call our office at 301-631-1207.

Market Update - QUarter Ending December 31, 2023

By Brad McMillan & Sam Millette

Solid December Caps Strong Year for Markets

Markets continued to rally in December, with the positive returns contributing to a strong end to the year. The S&P 500 gained 4.54 percent in December, 11.69 percent in the fourth quarter, and an impressive 26.29 percent over the course of the year. The Dow Jones Industrial Average (DJIA) was up 4.93 percent for the month, 13.09 percent for the quarter, and 16.18 percent for the year. The technology-heavy Nasdaq Composite saw the largest gains with the index up 5.58 percent in December, 13.79 percent during the quarter, and 44.64 percent for the year. Markets were boosted by signs of continued economic growth and falling interest rates at year-end.

Fundamental factors were supportive for markets to end the year. Per Bloomberg Intelligence, the average earnings growth rate for the S&P 500 in the third quarter was 4.48 percent. This was notably better than analyst estimates at the start of earnings season for a 1.22 percent decline in earnings. The better-than-expected quarterly results were widespread, as earnings growth in most sectors beat expectations. Over the long run fundamentals drive market performance, so the return to solid earnings growth during the quarter was a positive sign for investors.

Technical factors were also supportive during the month, as all three major U.S. indices ended the month well above their respective 200-day moving averages. This now marks two consecutive months with all three indices ending the month above trend. The 200-day moving average is a widely monitored technical signal, as prolonged breaks above or below this level can signal shifting investor sentiment for an index. The combination of improving fundamentals and supportive technicals to end the year are a good sign for U.S. equities as we head into the new year.

The story was much the same internationally, as a year-end rally helped support solid performance for international stocks over the quarter and year. The MSCI EAFE Index gained 5.31 percent in December, 10.42 percent during the quarter, and a solid 18.24 percent throughout the course of the year. The MSCI Emerging Markets Index gained 3.95 percent in December, 7.93 percent for the quarter, and 10.27 percent for the year. Technical factors were supportive for international stocks to end the year, with both the MSCI EAFE and MSCI Emerging Markets indices finishing the month above trend. This now marks two straight months with continued technical support for foreign stocks after a three-month stretch from August through October where both indices fell below their respective trendlines.

Fixed Income Continues to Rally

Fixed-income markets continued to rally to end the year, supported by falling interest rates. The 10-year U.S. Treasury yield fell from 4.37 percent at the end of November to 3.88 percent at the end of December. Short-term rates fell as well, with the two-year Treasury yield dropping from 4.73 percent at the end of November to 4.23 percent to end the year. The Bloomberg Aggregate Bond Index gained 3.83 percent for the month and 6.82 percent for the quarter. The strong fourth quarter helped offset earlier weakness for the index, which finished the year with a 5.53 percent return.

High-yield fixed income also performed well to end the year. The Bloomberg U.S. Corporate High Yield Index gained 3.73 percent for the month, 7.16 percent for the quarter, and 13.45 percent throughout the year. High-yield credit spreads ended the year at 3.32 percent, which was well below the 2023 high of 5.22 percent we saw in March and the 3.84 percent level at the end of November. The fall in credit spreads to close the year indicates that investors ended the year with a rising appetite for riskier, high-yield securities.

Economic Updates Show Continued Growth

The economic updates released in December painted a picture of continued economic growth to end the year. Hiring accelerated in November, with a better-than-expected 199,000 jobs added during the month. We also saw a rebound in consumer confidence in December, as increased consumer optimism caused both major measures of consumer sentiment to end the year at multi-month highs.

The improved consumer sentiment was due in part to further progress in the fight against inflation. Headline consumer inflation fell to 3.1 percent on a year-over-year basis in November, well below the recent high of 9.1 percent that we saw in June 2022. While there is still work to be done to get inflation back down to the Fed’s 2 percent target, the improvement we’ve seen over the past two years is an encouraging sign that we are heading in the right direction. Consumers responded to the falling inflation figures by lowering their inflation expectations, which in turn helped support the rise in sentiment at year-end.

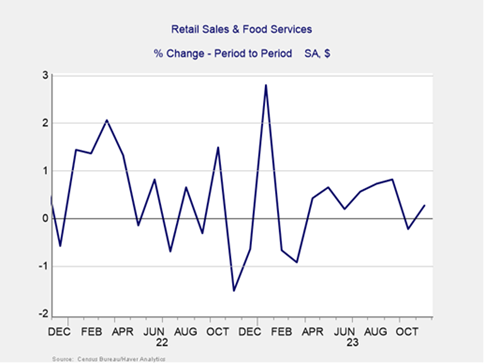

The improving confidence was an encouraging sign as historically higher levels of confidence have supported faster spending growth. Speaking of spending growth, retail sales and personal spending both improved in November, which is a good sign for sales during the busy holiday season. As you can see in Figure 1, the 0.3 percent rise in retail sales in November represented a rebound following a surprising drop in sales in October.

Figure 1: Retail Sales & Food Services, December 2020–Present

Source: Census Bureau/Haver Analytics

Source: Census Bureau/Haver Analytics

Given the importance of consumer spending on the overall economy, the return to spending growth, and improved confidence at year-end are a positive signal for the economy as we kick off the new year.

Focus on the Fed

With inflation continuing to show signs of improvement and markets rallying on the news, one of the major question marks as we enter 2024 is what the Fed has planned for monetary policy throughout the course of the year. The Fed kept interest rates unchanged at its December meeting and Chair Powell indicated in his post-meeting press conference that the central bankers were considering cutting interest rates in 2024. He did indicate that the timing for any future cuts will remain dependent on developments in economic data.

We ended the year with markets pricing in a total of six interest rate cuts throughout 2024. Fed members, on the other hand, ended the year projecting a median of three interest rate cuts in 2024. This disconnect between Fed and market rate expectations will be worth monitoring in the months ahead, as it could represent a risk to markets if investors overestimate the Fed’s willingness to cut rates throughout the course of the year.

Any talk of rate cuts will be dependent on how inflation and the economy develop in 2024. While the most likely path forward is for continued modest improvement in the months ahead, we could still see inflation reaccelerate, which in turn could lead to delayed rate cuts or even rate hikes at future Fed meetings. While the progress we’ve made so far in combating inflationary pressure has been impressive, we’re not in the clear when it comes to inflation and the Fed.

Risks to Monitor

While the Fed and inflation remain the most immediate risks, there are other risks to markets and the economy. Domestically, the U.S. elections in November are approaching and could lead to uncertainty in the second half of the year.

International risks remain as well, highlighted by ongoing wars in Europe and the Middle East. While the immediate market impact from the current conflicts has been muted, we could see an escalation that could lead to further instability in the regions. International shipping and supply lines may be especially vulnerable to rising tension in the Middle East and this will be an important area to monitor in the months ahead given the importance of international trade in the fight against inflation.

Finally, we also have unknown risks that could negatively impact markets. At this time last year few investors were talking about weakness in the U.S. banking industry or a potential government default, both of which caused brief bouts of market turbulence in 2023.

Positive Outlook for the New Year

Despite the real risks that remain for markets and the economy, the overall outlook remains positive as we head into the new year. Market fundamentals and technicals ended the year on a high note with a return to earnings growth and solid technical support toward year-end. Additionally, economic fundamentals continue to show signs of a healthy, expanding economy which should set the stage for continued market gains in 2024.

Consumer spending remained impressively resilient throughout most of 2023 and improved consumer confidence at year-end should support continued spending in 2024. Business confidence and spending also showed signs of solid growth to end the year. Looking forward, we appear poised for continued positive economic and market performance in the months ahead.

There are real risks to this outlook that remain. Inflation, the Fed, and rising geopolitical risk remain front of mind as we head into the new year but other risks may develop as well.

It’s important to remember that even in strong years for markets, investors can face a bumpy ride along the way. Going back to 1980, the average intra-year price decline (the average annual price decline from peak-to-trough during the year) for the S&P 500 was 14.2 percent, while the average annual return was 9 percent. This means that even though the S&P 500 averaged high single-digit annual returns over this time, periods with sell-offs were a common feature almost every year. This was true in 2023, as the S&P 500 fell by 10 percent from peak-to-trough but ended the year up more than 26 percent on a total return basis.

Given the history of volatility for equity markets and the potential for short-term uncertainty due to the risks markets face, a well-diversified portfolio constructed to withstand bouts of market turbulence remains the best path forward for most investors.

Moore Wealth

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non- investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, director, fixed income, at Commonwealth Financial Network®.

Moore Wealth is located at 50 Carrol Creek Way, Suite 335, Frederick MD 21701 and can be contacted at 301-631-1207. Advisory services are offered through Moore Wealth®, a Registered Investment Adviser.

© 2023 Commonwealth Financial Network